Anúncios

Enjoy one of the UK’s lowest APRs

The TSB Advance Credit Card is designed for individuals seeking a reliable, low-interest credit card with practical benefits and manageable terms.

TSB is known for its customer-first approach, offering services that reflect simplicity, trust, and clarity. The Advance Credit Card continues this tradition with flexible features for everyday financial control. If this option interests you, keep reading to learn more details and how to apply.

| Credit Score | Annual Fee | APR (Annual Percentage Rate) | Rewards |

| Varies based on eligibility | £0 | 12.9% APR (variable) | Priceless.com experiences, discounts |

Information provided by the official website of TSB.

Credit Card

TSB Advance Credit Card

Analysis of the significant aspects of TSB Advance Credit Card

The TSB Advance Credit Card offers a competitive 12.9% APR (variable), making it one of the lowest rate cards available in the UK credit market today.

This card features 0% interest on purchases and balance transfers for the first three months. There’s also no balance transfer fee during the initial 90 days.

Cardholders also can manage their accounts via mobile app and Internet Banking, making this card a flexible choice for digital-savvy users.

Additionally, users enjoy compatibility with Apple Pay, Google Pay, and Samsung Pay, making daily spending quick and secure.

Considerations regarding the positive and negative attributes of TSB Advance Credit Card

This credit card stands out for its simplicity and cost-effectiveness, though it’s important to weigh both pros and cons when applying. So let’s do this:

Positive attributes

- Exceptionally Low APR: With a representative 12.9% APR (variable), the card offers one of the most competitive rates available in the market, ideal for long-term balances.

- Introductory Interest-Free Period: Enjoy 0% interest on both purchases and balance transfers for the first three months, providing valuable breathing room for larger expenses.

- No Initial Balance Transfer Fee: Transfer existing balances from other credit cards within 90 days of account opening without any fees, helping reduce interest payments from day one.

- Digital Payment Compatibility: Easily link the card to Apple Pay, Google Pay, or Samsung Pay, enabling contactless, secure transactions in-store and online.

- Access to Priceless.com: Mastercard holders can benefit from exclusive experiences and discounts in the UK and abroad, adding lifestyle value to the card.

- Section 75 Protection: Purchases between £100 and £30,000 are covered, giving cardholders peace of mind for online and offline purchases.

Negative attributes

- Limited Promotional Period: The 0% interest on purchases and balance transfers only lasts for three months. After this, interest applies at the standard variable rate.

- Post-Promotion Balance Transfer Fee: Once the 90-day window closes, a high 5% balance transfer fee applies, which can diminish cost-saving benefits for late transfers.

- No Rewards or Cashback: While it includes access to Priceless.com, the card lacks a traditional rewards or cashback scheme that many competitors offer.

- Fees for Cash Withdrawals and Late Payments: Interest is charged immediately on cash advances, and a £12 fee is applied for missed payments or if you exceed your limit.

- Eligibility Requirements May Exclude Some Applicants: Individuals with poor credit histories or irregular income may find it challenging to meet the lending criteria.

Instructions for submitting a request for TSB Advance Credit Card

Starting your application for the TSB Advance Credit Card is both simple and convenient, designed to give you clarity from the very first step.

By checking your eligibility online, you can find out if you’re likely to be accepted without affecting your credit score. This helps ensure you’re making an informed decision before proceeding further. To understand this better, let’s look at the detailed process below. Take a look:

Eligibility requirements to apply

- You must be at least 18 years old

- Be a UK resident

- Have a regular income

- Not be bankrupt or have County Court Judgments or individual voluntary agreements

Choose the application method for TSB Advance Credit Card that suits you best

You can apply online if you are not an existing TSB customer by visiting the official TSB website. The process takes only a few minutes.

Existing TSB customers can log into Internet Banking and apply directly through their account dashboard.

When applying, you will need your current UK address, bank details (account number and sort code), and any balances you wish to transfer.

The application uses a soft credit check initially, which won’t impact your credit score, making it a safe step for most.

The sequence of steps for acquiring TSB Advance Credit Card

- Visit the TSB website and check your eligibility.

- Gather the required documents and information.

- Submit the online form with accurate details.

- Wait for approval and receive your card by post if accepted.

Credit Card

TSB Advance Credit Card

Reviewing other financial options available: Barclaycard Forward Credit Card

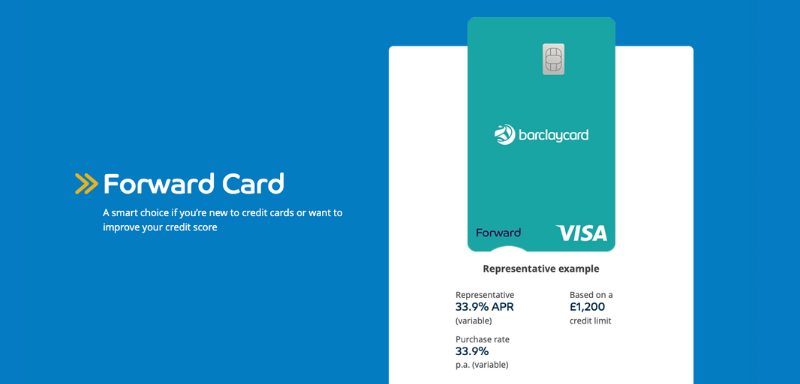

If the TSB Advance Credit Card does not fully align with your financial needs or credit-building goals, there is another compelling option worth considering. The Barclaycard Forward Credit Card offers a tailored solution for individuals looking to start or improve their credit history.

Barclaycard, a division of Barclays Bank, is a well-established name in the UK financial sector, known for its reliability and innovation. The Forward Credit Card is purposefully designed for those with limited or no credit history and includes features to encourage responsible borrowing.

This card provides 0% interest for six months on purchases and balance transfers, along with a manageable initial credit limit of £50 to £1,200 based on your financial situation. These terms help new cardholders gain control without overwhelming financial commitments.

One of its standout features is the opportunity to lower your interest rate over time—a 3% reduction in the first year and a further 2% in the second—by making timely monthly payments. Users also benefit from app support, smart alerts, and access to Barclaycard Entertainment perks.

If you’re seeking a credit card to improve credit score, the Barclaycard Forward Credit Card offers a practical path with structured guidance. Visit our next article to learn more about this alternative and decide if it better suits your financial goals.

Related Content

Barclaycard Forward Credit Card

While accurate at the time of posting (April 10, 2025), some of the offers referenced may have since expired.