Anúncios

Turn everyday shopping into real value with this rewards card

M&S Bank, a respected UK financial provider under HSBC UK, delivers trusted credit solutions designed around customer ease, retail rewards, and convenient mobile account management.

As a UK shopper, this card unlocks bonus points, flexible repayments, and retail vouchers, aligning your everyday spending with meaningful financial returns.

Credit Card

M&S Bank Rewards Credit Card

It brings a tailored mix of welcome offers and value-driven rewards that suit different lifestyles, helping you shop smart and manage credit effectively.

With up to 9 months of 0% interest on purchases and balance transfers, it supports cost management and makes rewards more accessible with no annual fee. Keep reading to discover all the features and benefits it offers.

| Credit Score Requirement | Annual Fee | APR (Representative) | Rewards |

|---|---|---|---|

| Good to Excellent | £0 | 23.9 % variable | 5 pts/£1 at M&S (first 6 months), then 1/£1 at M&S, 1/£5 elsewhere; quarterly voucher conversion |

Analysis of the significant aspects of M&S Bank Rewards Credit Card

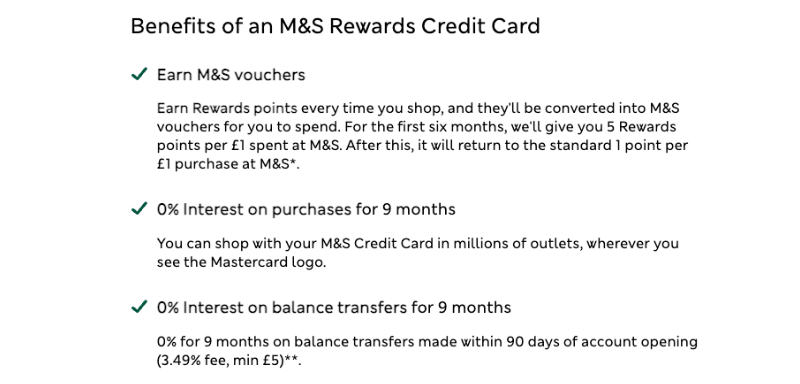

The M&S Bank Rewards Credit Card offers a compelling introductory deal that awards 5 Rewards points per £1 spent at M&S during the first six months, making it ideal for loyal shoppers.

You also receive 0 % interest on purchases for nine months from account opening, allowing you to spread the cost interest‑free, provided minimum payments are made.

For balance transfers, the card extends a 0 % interest period of nine months with a 3.49 % fee (minimum £5), which may help consolidate existing debts.

After the promotional period, the standard APR is a representative variable rate of 23.9 %, which is competitive for a rewards credit card with such benefits.

Considerations regarding the positive and negative attributes of M&S Bank Rewards Credit Card

The M&S Bank Rewards Credit Card delivers strong rewards and 0 % interest phases, ideal for shoppers, but consider your payment habits and post‑promotion APR carefully.

Positive attributes

- Generous welcome bonus, offering 5 points per £1 spent at M&S for the first six months, significantly boosting your rewards early on.

- No annual fee, allowing cardholders to benefit from rewards and promotions without any fixed cost.

- Quarterly voucher conversion, automatically turning points into usable M&S vouchers every three months to simplify redemption.

- 0 % interest periods on purchases and balance transfers for nine months, supporting budget flexibility and short-term financial planning. on purchases and balance transfers for nine months.

Negative attributes

- High standard APR of 23.9 %, which can lead to costly interest charges if balances are not paid in full after the promotional period ends.

- Rewards capped to M&S, meaning you gain the most value only when shopping at Marks & Spencer, limiting broader appeal.

- Balance transfer fee of 3.49% (minimum £5), reducing the effectiveness of the 0% interest promotional offer for balance consolidation.

- Requires disciplined repayment, as missing minimum payments can forfeit promotional rates and lead to additional charges or negative credit impact., or benefits diminish quickly.

Instructions for submitting a request for M&S Bank Rewards Credit Card

Explore how to apply for the M&S Bank Rewards Credit Card, starting with eligibility checks and choice of application method.

Eligibility requirements to apply

Applicants must be UK residents and at least 18 years old to qualify for the credit card offer.

They must hold a UK bank account and be able to provide standard financial documentation when applying.

M&S Bank will assess creditworthiness through a standard check, reviewing both score and history for approval.

Using the eligibility checker first is advised, as it won’t affect your score and helps avoid multiple hard applications.

Choose the application method for M&S Bank Rewards Credit Card that suits you best

You can apply online through the official M&S Bank website using the eligibility checker for a fast response.

Alternatively, the M&S Banking App allows secure application submission, access to mobile banking, and control over card features.

Existing customers can use Internet Banking to apply, integrating card management with other M&S financial accounts.

Those who prefer personal support can visit an M&S store or contact customer services for guided application assistance.

The sequence of steps for acquiring M&S Bank Rewards Credit Card

To help you make a confident application, here’s how the M&S Bank Rewards Credit Card process unfolds clearly and efficiently:

- Use the eligibility checker online or via app.

- Submit necessary personal and financial details.

- Receive instant decision.

- Upon approval, receive card promptly and begin usage.

- Enrol in Sparks digital rewards via app.

- Monitor spending, accumulate points, use app to redeem vouchers quarterly.

Completing these steps ensures a smooth setup, letting you enjoy the card’s full rewards and management features without delay.

Credit Card

M&S Bank Rewards Credit Card

Reviewing other financial options available: Aqua Classic Credit Card

The M&S Bank Rewards Credit Card offers attractive rewards, but it’s designed mainly for shoppers with a strong credit profile and loyalty to M&S.

If you’re working to rebuild or establish your credit score, the Aqua Classic Credit Card presents a practical, no-fee alternative tailored for financial improvement.

Backed by NewDay Ltd, Aqua supports users with tools like Aqua Coach, credit monitoring, and flexible limits between £250 and £1,500 based on your profile.

It doesn’t offer rewards, but it helps build healthy credit habits through mobile tools, soft eligibility checks, and personalised repayment support.

To compare both options in more depth and see which fits your goals, check out our next article with full analysis and user scenarios.

Related Content