Anúncios

A powerful solution for consolidating debt with extended 0% interest

MBNA, a reputable brand under Lloyds Banking Group, is known for offering straightforward and efficient credit card solutions.

Their services are designed to help individuals better manage personal finances and control existing debt.

Credit Card

MBNA Balance Transfer Credit Cards

The MBNA Long Balance Transfer Credit Card presents a compelling option for those aiming to consolidate credit or store card balances, thanks to a generous 0% interest period and zero annual fees.

Keep reading to see how this card could help you save on interest and simplify your finances.

| Feature | Details |

|---|---|

| Credit Score | Good credit history required |

| Annual Fee | £0 |

| APR (Annual Percentage Rate) | 26.9% representative APR (variable) |

| Rewards | Not applicable |

Analysis of the significant aspects of MBNA Long Balance Transfer Credit Card

This card offers a 0% interest period on balance transfers for up to 31 months, giving users ample time to repay outstanding balances without accruing interest.

To take advantage of this benefit, balance transfers must be completed within the first 60 days of account opening, with a 3.49% transfer fee applied.

Once the promotional period concludes, the interest rate reverts to 26.94% p.a. variable, and any new transfers are subject to a 5% fee, making timely action important.

The card also includes a 0% interest offer on money transfers for up to 9 months, with a 4% fee, which can help manage other financial obligations.

Considerations regarding the positive and negative attributes of MBNA Long Balance Transfer Credit Card

This section offers a comprehensive overview of the benefits and limitations associated with the MBNA Long Balance Transfer Credit Card to support an informed decision.

Positive attributes

- Benefit from a lengthy 0% interest period on balance transfers, helping you manage and repay debt more affordably.

- Enjoy a no annual fee structure, making the card an accessible and low-cost financial tool.

- Transfers are processed quickly, often by the next working day, allowing for faster consolidation.

- Manage your account with ease using digital tools like MBNA’s mobile app and secure online services.

- Get support when you need it through 24/7 UK-based customer service and full fraud protection for your peace of mind.

Negative attributes

- A 3.49% balance transfer fee applies initially and increases to 5% after 60 days, which may affect your total savings.

- The card does not offer promotional interest rates on new purchases, which may result in additional charges.

- Balance transfers from other MBNA-issued cards are not accepted, limiting options for existing customers.

- A high APR of 26.9% variable applies after the promotional term, which could lead to expensive repayments.

- Eligibility criteria are strict, requiring good credit, UK residency for at least three years, and a stable income.

Instructions for submitting a request for MBNA Long Balance Transfer Credit Card

Getting the MBNA Long Balance Transfer Credit Card is a simple, straightforward process that can be done entirely online.

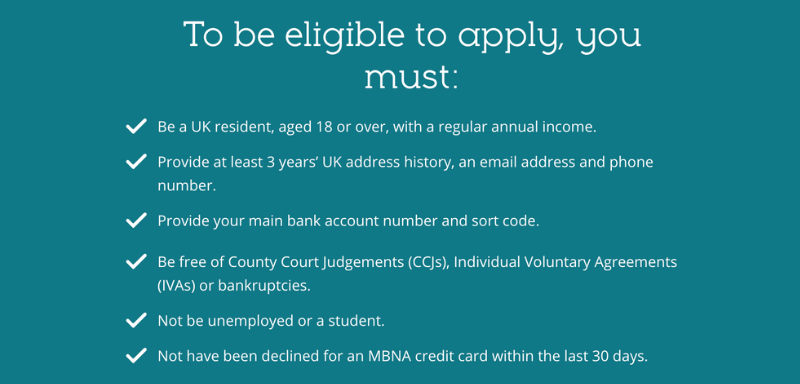

Eligibility requirements to apply

To apply, you must be a UK resident aged 18 or over with a regular annual income and an active UK bank or building society account.

Additionally, applicants need to have lived at a UK address for the past three years and must provide a valid email address and phone number.

You should not be unemployed or a student, and individuals with County Court Judgements (CCJs), IVAs, or bankruptcies are not eligible.

Applicants also must not have been declined for an MBNA credit card in the last 30 days. Credit history and income will be assessed to determine affordability.

Choose the application method for MBNA Long Balance Transfer Credit Card that suits you best

Use the Clever Check tool on the MBNA website for a soft search that won’t affect your credit score and will estimate your likely credit limit.

After pre-checking eligibility, proceed to the online application and complete the form with personal and financial details, including balance transfer amounts.

For those preferring phone support, MBNA’s UK-based customer service team is available to help answer questions and assist with the application.

Ensure balance transfers are submitted within 60 days of account opening to access the full promotional benefits and lower transfer fees.

The sequence of steps for acquiring MBNA Long Balance Transfer Credit Card

If you’re ready to apply, the following steps will guide you through the process and help you start benefiting from the MBNA offer quickly:

- Begin with the Clever Check tool to verify eligibility.

- Fill out the application with accurate personal and financial information.

- Submit details of the balances you wish to transfer.

- Await approval and confirmation; your transfer should complete by the next working day.

Once approved, you’ll receive your MBNA card and can manage your balance using their secure mobile app or online account system.

Credit Card

MBNA Balance Transfer Credit Cards

Reviewing other financial options available: Aqua Classic Credit Card

The MBNA Long Balance Transfer Credit Card is well-suited for individuals with strong credit looking to consolidate existing balances and reduce interest payments over an extended period.

However, for those with limited or poor credit history, this card may not be accessible. In such cases, the Aqua Classic Credit Card offers a supportive alternative.

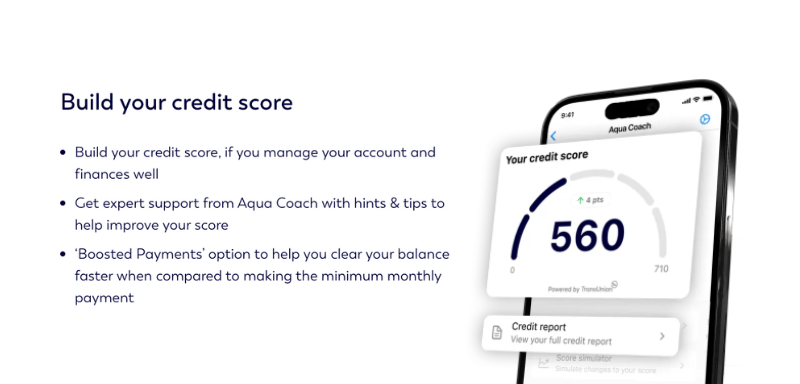

Aqua Classic is designed to help users rebuild their financial standing. It features no annual fee, an initial credit limit from £250, and a representative APR of 34.9% variable.

It also includes helpful digital tools such as Aqua Coach and Boosted Payments, with 24/7 fraud protection and Mastercard acceptance for everyday use.

To discover how the Aqua Classic Credit Card could support your credit improvement efforts, click below and read our dedicated article for more details.

Related Content