Anúncios

Enjoy mobile account control, no annual fee, and credit-building support

The Capital One Classic Credit Card is tailored for UK residents looking for a simple way to improve their financial standing through responsible credit use.

Offered by one of the most trusted credit card companies UK, this card helps users manage spending while working towards better financial health and creditworthiness.

With features supporting responsible use, the Capital One Classic Credit Card encourages good habits that can improve your score. Learn more below and see why this could be right for you.

| Feature | Details |

|---|---|

| Credit Score | Suitable for individuals with limited or poor credit history |

| Annual Fee | £0 |

| APR (Annual Percentage Rate) | 34.9% representative variable |

| Rewards | No rewards program |

Credit Card

Capital One Classic Credit Card

Analysis of the significant aspects of Capital One Classic Credit Card

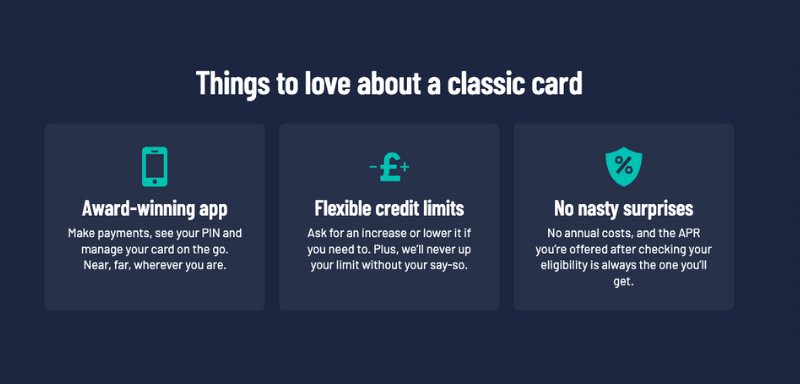

To begin with, the Capital One Classic Credit Card offers a flexible starting credit limit ranging between £200 and £1,500, based on individual eligibility and financial history.

In addition, users may receive up to two credit limit increases per year when they manage their account responsibly and make timely payments.

Furthermore, Capital One provides an award-winning mobile app, allowing users to manage their card, see their PIN, and make payments from anywhere with ease.

Finally, there are no annual fees, and the APR disclosed during the eligibility check will be the exact rate offered upon approval, eliminating hidden surprises.

Considerations regarding the positive and negative attributes of Capital One Classic Credit Card

Understanding both the advantages and limitations of the Capital One Classic Credit Card ensures a better match for your financial goals:

Positive attributes

- No annual fee: There are no yearly maintenance costs associated with this card, allowing users to build credit without added financial pressure.

- Transparent APR: The APR you see during the eligibility check is the exact rate you’ll receive if approved, providing certainty and avoiding hidden charges.

- Interest-free period: Benefit from up to 56 days interest-free on new purchases, as long as the balance is paid off in full each month.

- Credit building support: Using the card responsibly by paying on time and staying within limits can significantly boost your score.

- Highly rated mobile app: The app lets you manage your account, view statements, and make payments anytime, from anywhere.

- Strong customer support: Access support via the Capital One phone number for queries or assistance.

- Purchase protection: Section 75 protection covers eligible purchases between £100 and £30,000, giving peace of mind on larger buys.

Negative attributes

- High APR: With a representative APR of 34.9% variable, the card can become costly if balances are not repaid in full monthly.

- No rewards programme: The card doesn’t offer cashback, air miles, or loyalty points, making it less appealing for those seeking spending incentives.

- Initial credit limits may be low: Many users start with lower credit limits, which might not accommodate larger purchases until responsible use is demonstrated.

- Strict consequences for misuse: Late or missed payments can lead to credit score damage and reduce eligibility for future credit limit increases.

Instructions for submitting a request for Capital One Classic Credit Card

Applying for the Capital One Classic Credit Card is a simple process designed for users seeking a credit card easy to get and suitable for building credit. Let’s see!

Eligibility requirements to apply

To begin with, applicants must be at least 18 years old and permanently reside in the United Kingdom. Being on the electoral roll significantly improves your approval chances.

Moreover, having a history of managing credit responsibly — such as paying bills on time and keeping within your limits — can strengthen your application, even if you have past CCJs or Defaults.

However, applicants who have declared bankruptcy within the last 12 months will not be considered. Demonstrating recent stable financial behaviour is essential during Capital One’s review.

Fortunately, a perfect credit history is not required. This card is ideal for rebuilding credit or for individuals applying for a credit card to build credit for the first time.

Choose the application method for Capital One Classic Credit Card that suits you best

Capital One provides multiple convenient ways to apply, each designed to suit different preferences. Whether you prefer digital tools or traditional methods, the process remains quick and secure:

- Online Eligibility Checker: Use QuickCheck to see if you’re eligible before you officially apply online. This doesn’t affect your credit score.

- Instant Decision: Once you fill out the online form, you receive a clear yes or no immediately, so you know whether to proceed.

- Simple Online Application: If accepted, move forward in one tap to credit card online apply, saving time and stress.

- Receive by Post: Once approved, your Capital One credit card is posted within days, ready to use.

The sequence of steps for acquiring Capital One Classic Credit Card

Getting started with the Capital One Classic Credit Card is straightforward. The application process is fully digital and user-friendly, with instant feedback on your eligibility:

- Visit the Capital One UK website and use QuickCheck.

- Receive an immediate eligibility decision without credit impact.

- If eligible, apply directly online in just a few clicks.

- Wait for your card to arrive and start building your score.

Credit Card

Capital One Classic Credit Card

Reviewing other financial options available: Tesco Bank Foundation Credit Card

If you feel the Capital One Classic Credit Card isn’t ideal for your needs, the Tesco Bank Foundation Credit Card is a notable alternative for building credit.

This card also supports individuals with limited credit history and comes with manageable credit limits and online tools to track your progress.

The Tesco Bank Foundation Credit Card provides access to Tesco Bank’s mobile and online platforms, allowing for convenient control of your finances.

Whether you choose Tesco or Capital One, both provide tools to help you grow your financial independence and build credit.

To learn more about the Tesco Bank Foundation Credit Card and determine if it’s the right option for your credit-building goals, visit the dedicated article linked below.

Related Content