Sorting out taxes Poland throws at newcomers can feel like untangling a bunch of receipts after payday. But, understanding the...

See more from: Aline B.

How Much Rent Costs in Poland by City: Full Breakdown and Insights

How Much Rent Costs in Poland by City: Full Breakdown and Insights Moving to a new city can feel a...

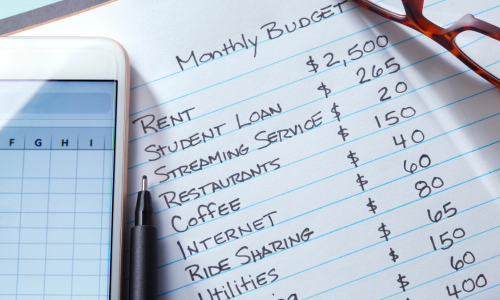

Monthly Expenses in Poland Real Examples and Smart Spending Tips

Planning life abroad feels like a puzzle—especially as you weigh up daily costs and real monthly expenses Poland brings. Sometimes...

Public Healthcare in Poland for Foreign Workers: Guide, Access, and Benefits

Moving to a new country brings daily surprises. For anyone arriving to work in Poland, one everyday concern is how...

Transportation Costs in Poland Explained: Detailed Analysis for 2024

Getting around in Poland can seem straightforward, but the details behind transportation Poland costs reveal important differences based on where...

Best Cities in Poland to Live and Work: 2024 Expert Guide to Top Locations

Dreaming about a fresh start or advancing your career in a new place sparks real excitement. Comparing the best cities...

Is Poland Expensive or Cheap to Live? A Guide to Living Costs Poland

Moving to a new country brings a wave of excitement—and serious planning. After all, everyone wonders how far their money...

How to Find Accommodation in Poland: Proven Steps and Local Tips

Securing a comfortable place to live shapes your experience abroad, especially when navigating accommodation Poland. Finding the right balance between...

Cost of Living in Poland for Foreign Workers: Local Insights and Current Trends

Cost of Living in Poland for Foreign Workers Moving to a new country feels like unpacking a suitcase with hidden...

Proven Ways to Stand Out in the Polish Job Market

Looking for success in your career can feel overwhelming, especially when you realize just how competitive the Polish job market...