Anúncios

A credit card built for rebuilding financial confidence

Aqua is a UK-based credit card provider, supported by NewDay Ltd, that focuses on helping people build or rebuild their credit through accessible and personalised financial products.

Designed with flexibility and support in mind, the Aqua Classic Credit Card is ideal for those with limited or poor credit history aiming to develop better financial habits.

Credit Card

Aqua Classic Credit Card

It features personalised credit limits, intuitive tools through a mobile app, and essential safeguards for day-to-day money management.

With no annual fees, Mastercard acceptance, and 24/7 fraud protection, Aqua empowers users to regain financial control. Keep reading to discover how this card can help you move forward.

| Credit Score | Annual Fee | APR | Rewards |

|---|---|---|---|

| Suitable for poor or limited credit history | £0 | 34.9% APR Representative (variable) | Aqua Coach, Boosted Payments, Credit Score Monitoring |

Analysis of the significant aspects of Aqua Classic Credit Card

Aqua provides an initial credit limit between £250 and £1,500, tailored to your circumstances and with the potential to grow as you manage your account well.

Since there are no annual fees, the card remains affordable and accessible, especially for those working to establish or rebuild their credit history.

A representative APR of 34.9% applies, although actual rates may differ based on your credit profile and financial behaviour.

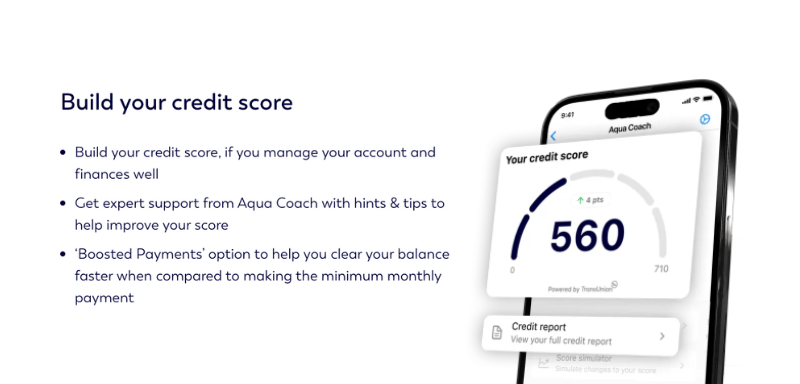

The mobile app offers convenient features such as Aqua Coach, payment reminders, and a repayment calculator, making it easier to stay on top of finances.

Considerations regarding the positive and negative attributes of Aqua Classic Credit Card

The Aqua Classic Card brings practical tools and flexible options for people rebuilding credit, but it’s important to consider all its features.

Positive attributes

- Completely free from annual fees, which means fewer financial burdens while building your credit profile responsibly.

- Credit limits start at £250 and may increase over time, rewarding responsible usage and supporting financial growth.

- Aqua Coach and Boosted Payments help structure repayments and offer guidance tailored to your credit progress.

- With Mastercard support, the card is accepted worldwide, providing freedom to shop in-store and online.

- Soft eligibility checks offer a quick and risk-free way to see if you qualify before applying formally.

- The app provides fraud protection and access to a UK-based customer service team for reassurance and guidance.

Negative attributes

- Although the representative APR is 34.9%, your rate may be higher—up to 59.9%—if your credit score is lower.

- The card doesn’t include cashback, travel points, or loyalty schemes, which may deter users seeking rewards.

- Applicants must meet strict eligibility standards, including no recent CCJs or bankruptcy, which can limit access.

- Promotional rates are limited or unavailable, so it may not be ideal for balance transfers or larger purchases.

Instructions for submitting a request for Aqua Classic Credit Card

Getting the Aqua Classic Credit Card is straightforward, offering a clear path for those looking to improve their credit with accessible support.

Eligibility requirements to apply

To apply for the Aqua Classic Credit Card, you must be at least 18 years old and a permanent resident of the United Kingdom with a UK address.

Applicants should not have been declared bankrupt in the past 18 months or be undergoing any current bankruptcy proceedings at the time of application.

You must not have received a County Court Judgement (CCJ) in the last 12 months, as this may impact your eligibility for the card.

Additionally, you must have a current UK bank or building society account and not currently hold or have recently held another Aqua or related card.

Choose the application method for Aqua Classic Credit Card that suits you best

Aqua allows users to apply online directly through its official website. This is the most convenient method, using the SafeCheck tool to evaluate eligibility quickly and safely.

Another method is to apply by phone, speaking with Aqua’s UK-based customer service team. They guide applicants step-by-step through the process and can address any specific queries.

It’s also possible to begin the application via reputable credit comparison websites, where users can view eligibility and be redirected to Aqua’s official platform for completion.

Though Aqua doesn’t offer in-branch services, users can receive live support over the phone while submitting the form online, providing a hybrid experience combining tech and personal guidance.

The sequence of steps for acquiring Aqua Classic Credit Card

Before starting the application process, it’s helpful to understand the order in which each step occurs. This ensures a smoother and more confident application experience.

- Use the online tool to check your eligibility.

- Fill out the full application with necessary details.

- Wait for a response regarding approval and your credit limit.

- Get your card and start using it once activated.

By following these steps in sequence, you increase your chances of a successful application and a positive start toward building stronger financial habits.

Credit Card

Aqua Classic Credit Card

Reviewing other financial options available: Marbles Credit Card

While the Aqua Classic Credit Card offers strong features for rebuilding credit, it’s always wise to consider your alternatives.

The Marbles Credit Card provides similar benefits and is also tailored for those establishing or improving their credit score.

With flexible credit limits between £250 and £1,500, and tools to track spending, it’s a practical and user-friendly choice.

Managed by NewDay Ltd, Marbles is known for its accessible service and strong security, making it a trusted name in credit.

To see if Marbles could better suit your situation, we invite you to visit our dedicated article for more detailed insights.

Related Content